As we approach November 2014, advertisers, agencies and marketers of all kinds will be taking a closer look at how the upcoming US elections may affect their media budgets, media availability, and share of voice.

2014 is a mid-term election year, and there are gubernatorial (36 states), senatorial (36 seats), congressional (all seats) and local ballots, all taking place on Tuesday November 4th.

Kiosk looked at current marketplace conditions and historical data to gauge where we should expect to see some impact on the media landscape due to political campaigning.

In local radio marketplaces, we should see minimal noticeable cost implications to the majority of FM station formats, but a stronger buyout in local AM news and talk stations may tighten avails throughout October. In mid-term years this buyout is driven primarily by ballot initiatives and propositions. And although mid-terms typically do not tend to draw as much media coverage as Presidential election years, there still tends to be a greater cost impact to local advertising marketplaces,. Through 2015, the absence of a Presidential election, as well as the hiatus of major media events such as the Olympics and the World Cup, should lead to a more regularized seasonality in national media pricing, with political spending having an impact on some local markets, particularly in Spot broadcast and cable TV.

When analyzing past presidential election years, historically we have noted:

- 2012 Political category spending increased 8x from the off-election year prior, with Presidential campaigns accounting for the largest share at 39% of the category’s spending

- The majority of political ad spending has historically concentrated in local markets, and we don’t anticipate that will change for 2016

- In 2012, 89% of political category spending was in local markets, compared to 29% for all other ad spending categories that year

- Locally, TV has taken the lion’s share of media, accounting for 87% of local political spend in 2012

- Presidential Campaigns put 97% of their local dollars in Spot TV

- Battleground states saw the heaviest impact, with some markets seeing upwards of 40% of all TV ad spend going to political advertising in the month prior to elections

- Display has seen an increasing presence in political advertising, comprising 60% of national spending in 2012

- We would expect this trend to continue in 2016, with 2014 election indications that political agencies will move towards programmatic solutions and target similar audiences to 2012

Ultimately, as the ad landscape evolves over the next two years, how political advertising affects rates across the board will depend on the shifting allocation of dollars by media channel.

Recent trends seem to predict greater allocation towards programmatic digital outlets (web, tablet, and mobile), where inventory is vast (dollars come in, but supply is great and growing) and costs are increasingly efficient. That shift could lend to a greater supply of unsold inventory in the more “traditional” channels (TV/Radio), where the commodity is more finite (as dollars go away, supply remains constant). However, as marketers get increasingly data-savvy, and more options for cross-platform remarketing become available, we should expect to see growth in “addressable” broadcast channels (Rentrak, cable and satellite set–top box data), sharing similar programmatic objectives.

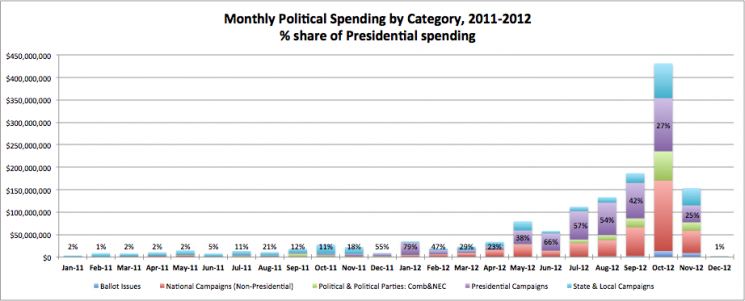

The following chart illustrates political spending leading up to the last presidential election:

Percentages shown are “Presidential” share of political spending. Presidential campaign spending was minimal in the year prior to elections, concentrated in Search and Display. From December 2011 and into the election year, presidential spending ramps up to peak in October, with notable pulses in January and June. Consistent throughout this ramp, the majority of spending is in Local TV.

As always, particularly for those marketers and advertisers targeting the political landscape or similar audiences (news, business, politics, finance), best practices are to plan as far ahead in advance as possible, and lock in deals sooner rather than later to secure pricing and inventory before the inevitable rush.

Research and analysis by Ben Johnsen and Christina Levant