With an upcoming election comes a flood of seasonal advertising spending that creates ripples far beyond any attempt to sway voters, with non-political advertisers losing mindshare to politicians, or seeing media costs creep upwards in battleground states where the bulk of political spending takes place.

As the Covid pandemic limits the amount of in-person campaigning and door-to-door canvassing taking place, dollars that would have been spent there may move into media warchests. And the role of social media advertising, already a cornerstone of highly-personalized political campaigning, is likely only to accelerate in prominence.

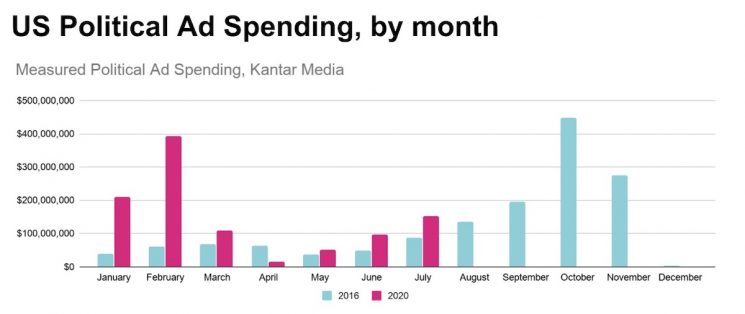

The election cycle got off to an unprecedented start, with Democratic candidates Bloomberg and Steyer burning through a combined $600 million during their presidential primary runs. This vastly inflated month-by-month spending figures in the early part of the year, when compared to 2016.

With the primaries out of the way and shelter-in-place kicking in, we briefly saw a dip below those 2016 spend figures. But the upward trend was back in place by June, with analysts at Kantar revising total election-cycle spend estimates to a potential $7 billion payday for publishers and platforms. One projection from the Center for Responsive Politics puts the likely election spending tally even higher — at $10.8 billion. That’s 50% higher than the 2016 cycle.

So where is the money going? And will that impact other advertisers, in terms of inventory limitations or soaring CPMs? The political spending spree is good news for media companies, who are seeing more eyeballs than ever as people stay home but spend less, choosing to spend their time on social media, on streaming services, and consuming broadcast TV.

In battleground states like Florida, Texas, Arizona, Pennsylvania, Wisconsin, Michigan, and North Carolina, pundits anticipate a lot of TV spending around NFL games, and on female- and urban-targeted networks like HGTV, Lifetime, Bravo, and BET.

A study by the Wesleyan Media Project covering digital spend suggests that since mid-April, Biden spent $101.8 million on Facebook/Google, while Trump spent $135.2 million. On the social front, Facebook’s Mark Zuckerberg has claimed that even with a projected spend of $420 million around political ads on the platform, that only represents 0.5% of Facebook’s likely 2020 revenues. As such, social media inventory may not be in short supply.

However, it’s worth considering the mindset of Facebook visitors during this particularly contentious election cycle. Are they in a receptive frame of mind for the type of messaging you’re putting forth? Or might they be too swept up in politics to pay attention to your campaign?

Savvy social marketers may consider expanding media plans to include options offered by newer channels and use the opportunity to experiment on platforms like TikTok (which has some well-publicized political issues of its own) or Quora.

For more niche B2B offerings, direct publisher buys on industry-specific media sites are likely to be unaffected by the political ad spend tidal wave. Additionally, fixed-cost options from pay-per-lead vendors may look more attractive in the short term, if you can lock in the right cost-per-lead. As ever, search marketing is always a smart place to capture high-intent interest.

If you do rely on Facebook to drive demand, now is not the time to “sit back and let the algorithm do the work.” Keep a close eye on your social campaign costs and consider a short-term funnel reassessment. If you do see increased cost for top-funnel metrics like CPMs and CPCs, in conjunction with reduced conversion rates due to higher competition, that may increase your lower-funnel costs-per-acquisition through October and November. It never hurts to revisit your optimization strategies, whether in an election cycle or not, because your own marketing is in a constant campaign against the competition.

Interested in taking a more agile approach to your media spending? Give Kiosk a call.